Heads they win, tails you lose.

Following the announcement initially released in last year’s Autumn Statement, new regulation regarding employees’ Benefit in Kind (BIK) tax treatment for salary sacrifice and cash alternatives to a company car has now been confirmed in the Finance Bill.

The legislation aims to ensure that benefits provided under what it calls ‘Optional Remuneration Arrangements’ (OpRA) no longer have the income tax and employers’ NICs advantages previously available under salary sacrifice arrangements and this also impacts cash alternatives offered in lieu of a company car.

Concentrating on Cash Alternatives – The new rules, outlined in the Finance Bill, will see employees taxed on the higher of either the BIK “Cash Equivalent” of the car taken or the gross cash amount being offered to an employee.

Therefore, the impact is for those employees who choose a company car with a cash equivalent that is lower than the gross cash amount offered as an alternative. Whilst there is no precise data on the number of employees in receipt of a cash alternative to a company car, it is believed that it may be as many as 500,000 employees in the UK today.

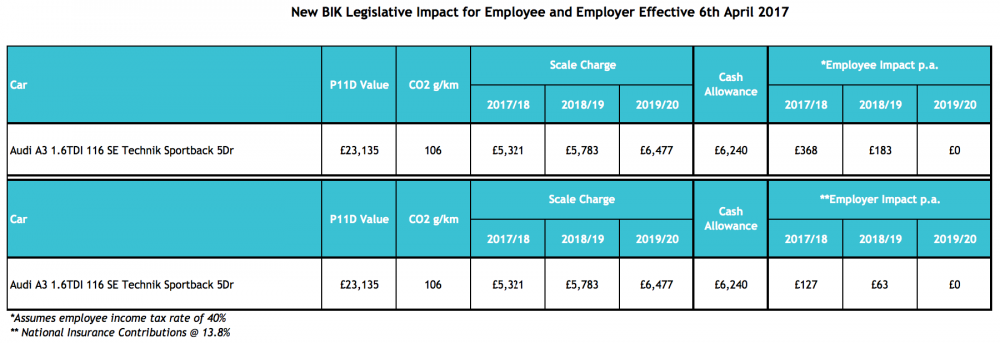

Example:

Ultra-Low Emission Vehicles (ULEVs) – i.e. cars with CO2 emissions of 75g/km or lower are exempt.

From 6th April 2017, all new cars ordered will be subject to the new rules. For existing company cars, the BIK tax remains unaffected until April 2021.

However, the Finance Bill states that if there is a variation to the agreement on a company car after 6th April, the new legislation will apply.

The definition of what constitutes a variation is open to interpretation. If a car agreement is amended to reflect mileage variance, then is it reasonable to judge that there is no material difference to the benefit being received by the driver. However, if a car contract is extended for a further 12 months this could this be construed as a variation as the employee is benefiting from the same lower BIK for a further 12 months and the new legislation would apply post variation.

Similarly, if you reallocate a car from one employee to another post 6th April, this also could be construed as a variation. HMRC expects employers to manage this process through the P11D reporting procedures.

Clearly it is difficult to understand the logic behind this legislation and it certainly does not drive the right employee behaviour in choosing a low CO2 car if he/she is to be taxed on a higher amount.

An already complicated landscape just got more so; organisations will need to review their policy on car versus cash alternatives and how they may need amending for the future. ERA fleet cost management’s experts are ideally placed to help organisations manage this latest legislative curveball – and the rest of your fleet operation.

For more information please contact us.

Article by: Sean Bingham