In a landscape where costs are rising, it’s inevitable that whether you’re a profit making firm or an institution, budgets and/or margin are being squeezed.

As rising costs hit the economy and an increase in inflation looks likely, what are the options you have?

- Raise prices: Contribute to inflation whilst losing market share. So a ‘no’.

- ‘Rationalise’ staff: Less effective at increasing EBITDA than reducing non-labour overheads.

- Cut profit: We’re sure your shareholders will accept it and it will only be this year, …right?

- Reduce costs: Identify and realise genuine cost savings to resurrect budget & morale.

We believe the best way to react to these circumstances is to pro-actively manage the full depth and breadth of your cost base.

Uncertainty is currently a fact of life, for people and businesses, even more so since the UK’s vote to leave the EU. Businesses may find it harder than ever to predict the future, but they can still manage it.

Smart companies realise that procurement can help them do this.

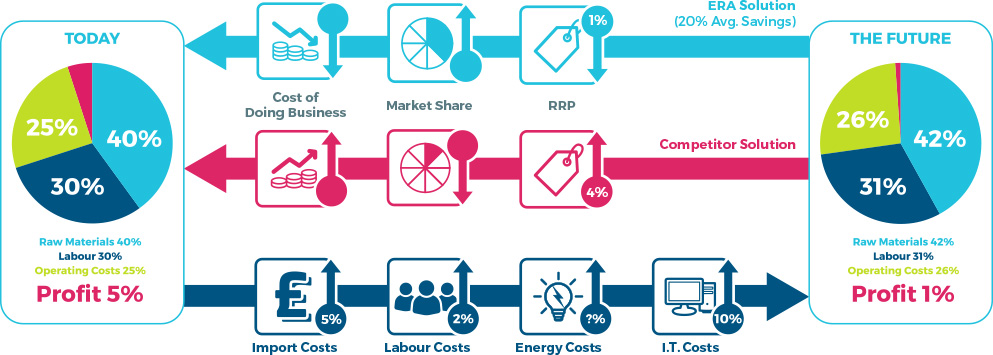

Today a typical cost split, bearing in mind staff, raw materials / goods for resale and overhead costs might look like the graphic above. In this example, we’re depicting a business that generates a fairly typical 5% profit margin on their overall turnover.

With the impact of a range of increases to general operating costs from both legislative and market changes, that organisation faces the potential of a profit squeeze to perhaps 1% in the future.

Many organisations will respond in the only way they can, raise prices to reflect increased input costs and face the potential of lost market share to organisations prepared to be more innovative.

By engaging with ERA and reducing your overall overhead costs by an average of 20%, responsible companies can in fact gain market share and drive back down the cost of doing business and ensure the profits you enjoy today remain for the future.

For more information, please contact us.